Once all the information is provided the system will offer you the payable tax amount. How to Calculate SST Malaysia.

Malaysia Sst Sales And Service Tax A Complete Guide

The manual guide covered topics of below.

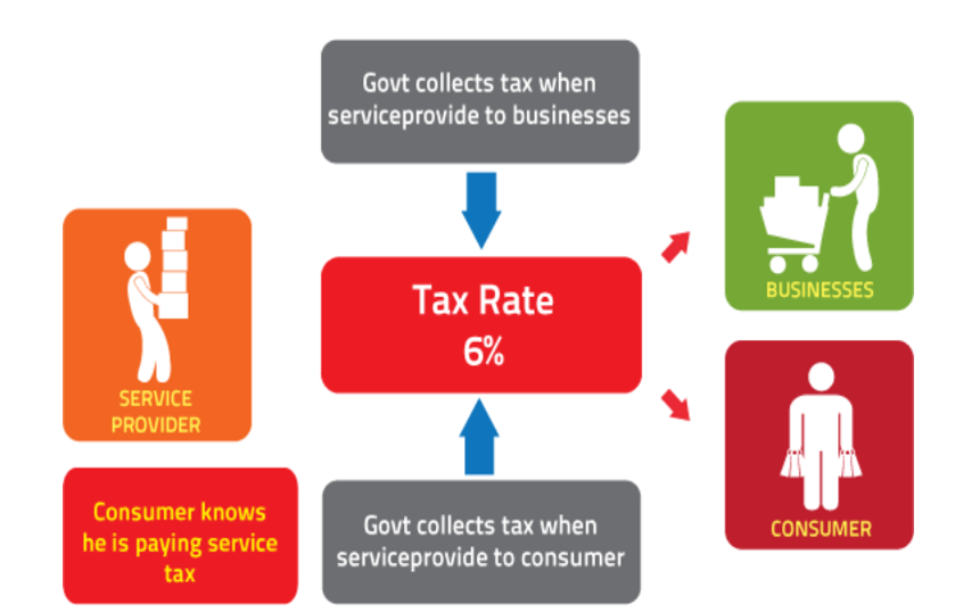

. Price without tax. Since 1st September 2018 Sales and Service Tax SST has been implemented to replace the Goods ad Service Tax GST in Malaysia. This also means all foreign entities including Labuan company who deal with Malaysian required to register the SST account as well.

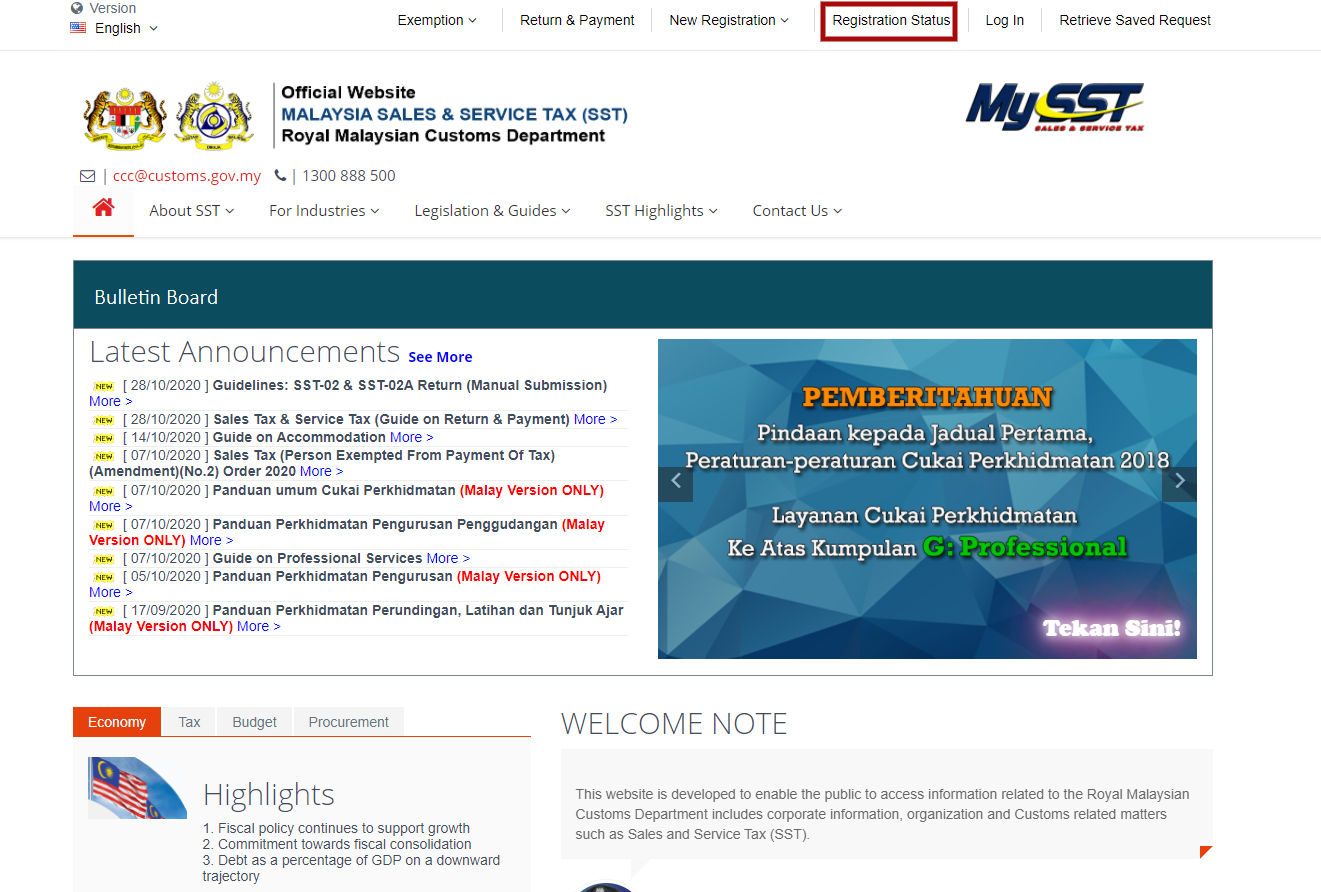

Payment StatusHistory To view the status and detail of your online payment Payment Receipt To print the receipt for the payment you have made. Fill up the form with appropriate information. This will guide you on how to make the return and payment through online at Official Website of Malaysia Sales Service Tax SST.

When youre in MySST portal click on Log In button to login to your account. SST-03 Application Form Application For Review Click Here. This website is developed to enable the public to access information related to the Royal Malaysian Customs Department includes corporate information organization and Customs related matters such as Sales and Service Tax SST.

SST-02A Form Service Tax Declaration By Other Than Registered Person Click Here. Price before tax and price are rounded two digits. The recently introduced Sales and Services Tax SST in Malaysia came into effect beginning 1 September 2018.

Ii How to Apply Online for Registration Sales Tax Or Service Tax Video Link Click Here. To Submit Sales Tax Return. The due date for SST payment is the last day of the following month from the taxable period which means the taxable period was two 2 months before.

When an invoice is issued to the customer. You need to fill in two fields. Online Payment a Procedure to Login Return Payment.

Steps to disable browser pop-up blocker. All goods sell into Malaysia also required to pay SST at a rate of 6. Sales Tax Persons Exempted.

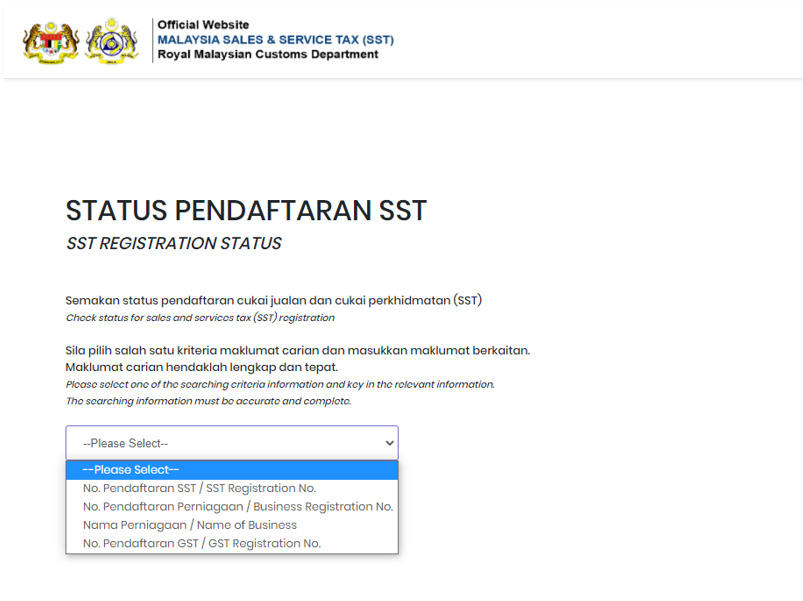

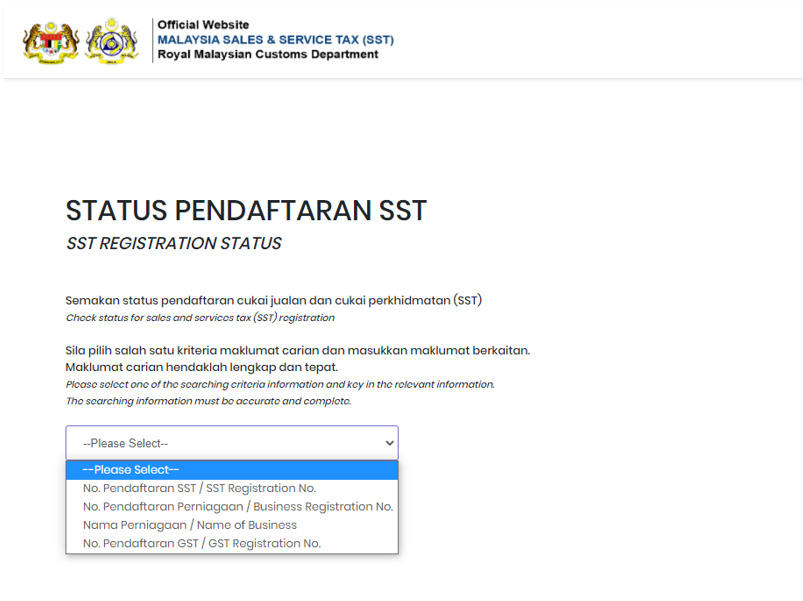

Ensure your eligibility in order to proceed to get yourself registered with the right SST code. Royal Malaysian Customs Department. Get recommended form for SST registration from the portal.

For payment of taxes online the maximum payment allowable is as follows. Lets know the Ways To Pay SST in the below information. Steps for Registration for SST Account.

BAHAGIAN CUKAI DALAM NEGERI IBU PEJABAT KASTAM DIRAJA MALAYSIA NO 22 MENARA TULUS PERSIARAN PERDANA PRECINT 3 62100 PUTRAJAYA. MOF - MINISTRY OF FINANCE. 5 To update license profile.

Claim for Refund Drawback of Duty Tax Others. SST Calculator Sales and service tax. Payment Payment Request To select all the SST submission for online payment.

Tax calculator needs two values. Get approval confirmation in the system. 18 rows LIST OF GUIDES.

The steps of SST registration process are as follows. When a cash payment is made by the customer. RMCD - ROYAL MALAYSIAN CUSTOMS DEPARTMENT.

I User Manual for Online Return and Payment Submission. Payment of sales tax and service tax can be made electronically through the MySST system Financial Process Exchange FPX or manually by cheque or bank draft. SST-02A Form Service Tax Declaration By Other Than Registered Person Click Here.

Pk 42 surat setuju terima sst pesanan. Service Tax is charged on a specific service provided by a taxable person in Malaysia carrying out a business. Once filled submit the form online through the system itself.

I User Manual Registration Click Here. The SST is a replacement of the previous Goods and Services Tax GST in Malaysia which prior to this imposed a 6 tax rate on all taxable goods and services. Https Mysst Customs Gov My Assets Document Sst User 20manual 20public 20user 20v1 0 Pdf.

The time when the supply is made. With the SST implementation every business owners are required to submit a tax return to the Royal Malaysian Customs Department every two months. Tribunal Rayuan Kastam TRK.

How To Submit Sst Malaysia Online. In addition SST course provider must. The new SST in Malaysia is a single-stage tax system which means that.

Apply for your SST Worker card online. For corporate account payments B2B the amount is RM100 million. Malaysian SST sets the time of supply the date at which the tax becomes applicable as the earlier of the following three points.

Fill in tax and price - and get price before tax as result. Businesses must submit the returns through the online portal of MySST. Do not fill in the currency.

Reminder List of reminder sent by system to user to submit the SST Return. LAMPIRAN J - PTK. SST Deregistration Process in Malaysia.

Sst return submit. The sst is also applied to the importation of taxable goods into malaysia at the rate of 5 percent or 10 percent or a specific rate depending on the category of products. This is essential as through this mechanism they can easily provide the essential details.

Voluntary Disclosure BORANG SST-ADM 2 Click Here. Once you have calculated the amount of sales and service tax you. Different from GST the government in Malaysia has set that SST will have a taxable period of 2 years while in GST different companies may have different length of taxable period.

To view Sales Tax License Information and Sales Tax Return Schedule.

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Bro Software Sst Guide Documentation

Malaysia Sst Sales And Service Tax A Complete Guide

Sst How To Declare Sst Return In Treezsoft Treezsoft Blog

Malaysian Service Tax Submission 2018 Mandarin Youtube

Sales Tax 2 0 Mysst Submission Mandarin Youtube

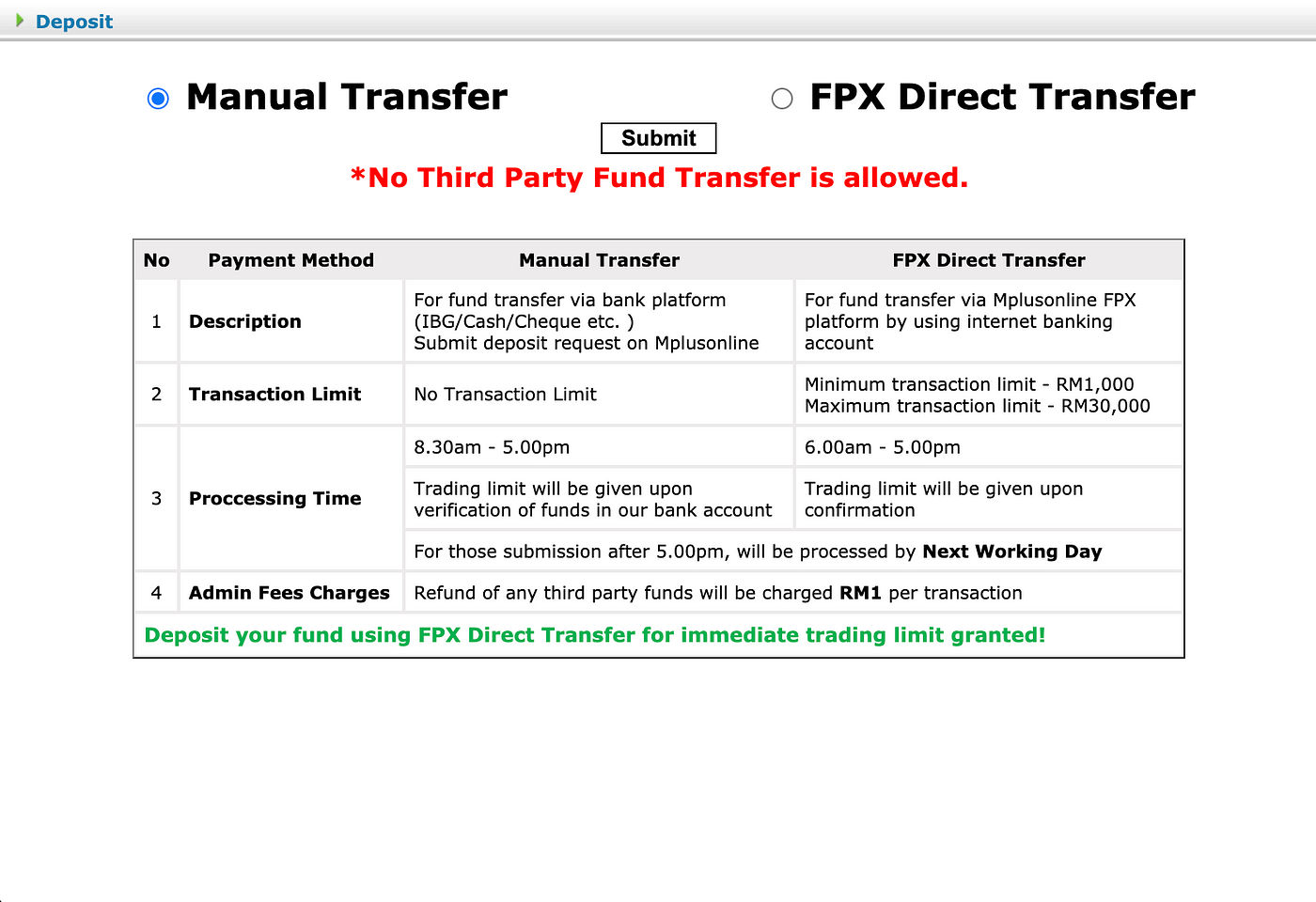

How To Use Mplus Online Medium

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

How To Use Mplus Online Medium

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0